India’s ESG Forerunners Will Be The Global Market Leaders: Esg Data & Solutions

India is a global economic leader with its Gross Domestic Product (GDP) sitting just below the world’s top 5, at number 6. The country’s economy is also growing rapidly. Its GDP is growing at a rate of nearly 9%, and India hosts the 3rd highest number of unicorn startups in the world, and, after nearly a decade of growth, its foreign direct investment (FDI) is expected to reach $100 billion in 2030. The study tells that India’s ESG forerunners will be the global market leaders, ESG data & solutions can help you find them.

But India’s economic power and rapid growth can be substantially impacted by environmental and social issues. To see how Indian businesses perform on environmental and social issues, we analyzed the 2021 annual reports of the top 1,000 Indian businesses. Our analysis revealed that when they are compared to organizations in other emerging markets the top 1,000 Indian businesses perform well on corporate social responsibility (CSR) criteria.

Below, we discuss why improving ESG performance is critical to securing future financial success for all companies and specifically for those in India. We take a look at how leading Indian businesses are currently performing in key ESG areas as well as what regulators are doing to drive ESG solutions. Finally, after discussing the results, we identify areas for improvement.

Table of Contents

- ESG Performance is Key to Financial Success

- Why Is Esg Performance So Key To The Future Financial Success Of Indian Businesses?

- Will Improved Local Regulations Help India Become A Global Leader In Esg Performance?

- How Well Are The Top 1,000 Indian Businesses Currently Performing On Esg Criteria?

- Environment (E)

- Social (S)

- Governance (G)

ESG Performance is Key to Financial Success

After many decades of growing pressure, environmental and societal concerns among all stakeholders, including governments, businesses, investors, and customers, have reached a tipping point. People around the world are increasingly worried about the climate crisis and social issues such as unemployment, poverty, and social inequality are top concerns.

In response, the world of corporate responsibility and sustainability has evolved to create greater corporate accountability. Whereas many leading organizations previously adopted a CSR-first approach, they are now expected to adopt an ESG-first approach. Business leaders are incentivized to follow this approach to take advantage of the rapidly growing amount of capital behind ESG investments. It is estimated that ESG investments could reach over $40 trillion by the end of 2022 and $50 trillion by 2050.

What is the difference between the CSR and the ESG approach? CSR involves the business voluntarily setting up a wide range of initiatives at any level of their organization that are often unrelated in the social or environmental issues they face as a business but instead may enhance the positive impact of the organization, primarily on social issues. Therefore, due to the varied and qualitative nature of CSR initiatives, it is challenging to compare one organization’s CSR initiatives to those of another.

In contrast, the ESG risk management involves business identifying material risks, creating a risk management framework and setting up quantitative targets, which are then monitored by the highest level of corporate hierarchy. Businesses are also expected to report externally on their ESG performance, allowing stakeholders to hold the business accountable and compare its ESG performance with other similar organizations.

Many of the world’s leading businesses now have ESG targets and capital is being devoted to reaching them. Increasingly businesses are also tying executive pay to ESG outcomes, with some of the most common being diversity, equity, and inclusion (DEI) targets and GHG reduction targets, such as goals to reach net zero emissions by a certain date. This increase in ESG and DEI claims, including their external visibility and ties to investment, has also led to greater scrutiny. KLM and Deutsche Bank are under investigation for greenwashing, while Google and Tesla are under investigation for racial discrimination.

Why Is Esg Performance So Key To The Future Financial Success Of Indian Businesses?

1) India Has A Significant Impact On The Environment And Society

India ranks 3rd in the world for countries that emit the most GHG emissions. It is also expected to soon overtake China as the world’s most populous country. Therefore India has an oversized impact on the environment and society. This increases scrutiny from foreign stakeholders on Indian businesses.

2) India Is One Of The World’s Largest Suppliers Of Goods And Services

The world depends on India for many products and services. In terms of products, India provides most of the world’s generic pharmaceuticals, including half of all vaccines. It is also the 2nd largest producer of cotton and produces 15% of the world’s sugar. But, as India’s largest sector, it is the services industry that leads the way in exports. While India’s merchandise exports rank 16th in the world in terms of the value they bring into the country, India’s services industry ranks 7th. The top exported services are those in the information communication technology (ICT) sector and, in an increasingly digital world, India is currently one of the world’s leading exporters.

India also has the potential to displace China as the world’s leading supplier. After the US’s trade troubles with China and the supply chain challenges of the COVID-19 pandemic, many governments and companies around the world have noticed that they are too reliant on China for key goods and services. To create more resilient supply chains, many governments and companies have been adopting a “China Plus One” strategy that seeks to add a supplier outside of China, usually in another Asian country.

However, to take full advantage of this strategy, Indian businesses must improve their ESG performance, particularly on climate and DEI criteria. Stakeholders across the board are increasingly aware that the most significant portion of a multinational’s GHG emissions, an amount likely over 70%, come from the business’ supply chain. This is known as scope 3 emissions. This means that Indian businesses looking to secure or maintain partnerships with US multinationals will need to implement world-leading GHG reduction strategies.

3) India’s Economy Is Uniquely Sensitive To The Impacts Of The Climate Crisis

According to the Intergovernmental Panel on Climate Change (IPCC), India is one of the countries that is most economically vulnerable to the negative impacts of the climate crisis. In fact, a Deloitte study found that India could lose 12.7% of its GDP by 2070 if it did not institute effective solutions to the climate crisis. Promisingly, the same Deloitte survey, found that India could gain $11 trillion if it did make the necessary changes to adapt. This places increasing pressure on Indian businesses to act on the climate crisis so that they can avoid significant losses and increase profits.

Will Improved Local Regulations Help India Become A Global Leader In Esg Performance?

Fortunately, the government of India has taken notice. It has set a target of net zero by 2070 and the Securities Exchange Board of India (SEBI) is introducing a new reporting framework, the Business Responsibility and Sustainability Reporting (BRSR) to align local ESG reporting standards with well accepted global guidelines such as the Global Reporting Initiative (GRI).

While compliance with BRSR is voluntary for India’s top 1,000 listed companies in India’s financial year (FY) 2021-22, it will be mandatory from FY 22–23. This means that companies will need to adapt quickly, though, this will be no easy feat. For many, it will include solving a global and local ESG talent shortage, setting up internal monitoring systems, and redirecting funds that have previously been allocated to the organization’s CSR initiatives. Large businesses that are part of major global supply chains have more resources and are leading the way, but mid-size and smaller with fewer resources will be expected to follow soon.

To remain competitive in today’s marketplace, no business can afford to stop at BRSR compliance. While these new regulations can be expected to increase ESG transparency, this should not be mistaken for ESG performance. The regulations do not set targets or provide incentives for high performance, such as access to more affordable finance or better resources. Investors, both local and foreign, are moving quickly to find high performers in ESG.

How Well Are The Top 1,000 Indian Businesses Currently Performing On Esg Criteria?

ESGDS’s data analysts took a close look at the 2021 annual ESG reports of the largest 1,000 Indian businesses by market capitalization. Our general opinion is that Indian businesses are performing well in comparison to other emerging markets due to increasing regulatory focus and Indian companies being part of global supply chains. We see that especially in terms of CSR initiatives (the majority of the top 1,000 Indian businesses have a community services policy), governance practices (the majority are compliant with SEBI’s Board Gender Diversity requirements) and reporting on social issues (the majority have a human rights policy).

By taking a look at how many of the top 1,000 Indian businesses disclose their support for the United Nations Sustainable Development Goals (UN SDG), the 17 environmental and social targets set by the United Nations to be accomplished by 2030. Our study finds that, more than 1 in 4, 26%, of these businesses disclosed their support toward the UN SDGs. This is par with global standards, if slightly lower. According to MSCI, in 2021, about 38% of the nearly 9,000 businesses in the MSCI All Country World Index were aligned with the UN SDGs.

Environment (E)

Environmental Monitoring

More than half of the top 1,000 Indian companies have environmental monitoring initiatives. Of these businesses, 63% have environmental supervision practices and over 68% have an environmental grievance redressal mechanism.

Energy And GHG Emissions

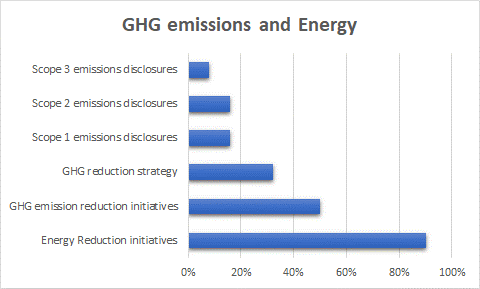

Nearly all of the 1,000 companies we researched, an incredible 90%, disclosed their energy reduction initiatives. Even more encouragingly, more than half of these companies, 65%, make use of renewable energy sources. It was less encouraging to discover that only 32% out of the 1,000 companies have a GHG reduction strategy, but this improves to over 60% when we only looked at the top 500 companies.

In addition, more than half, over 50%, of the 1,000 companies we looked into have initiatives to reduce their GHG emissions. However, their reporting on the scope of their emissions needs attention. About 16% of companies report on scope 1 (emissions from operations that the organization has direct control over) and scope 2

(emissions from the power sources that are necessary for running the organization’s direct operations) and only 8% report scope 3 (emissions from their supply chain). As we mentioned previously, requirements for scope-level GHG emission reporting will only be increasing.

Water

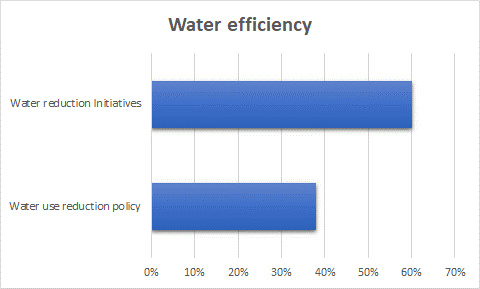

Promisingly, we found that 60% of the top 1,000 companies have water usage reduction programs. However, only about 38% of these top 1,000 companies have an official water use reduction policy, though, when looking at the top 500 companies, more than half, over 50%, have a water use reduction strategy.

Biodiversity

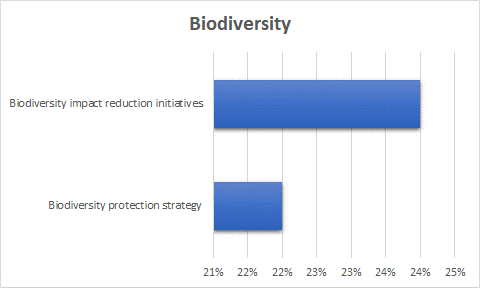

Somewhat less impressive is the 22% of companies in the top 1,000 that have a biodiversity protection strategy. However, this number increases to about 31% if we only consider the top 500 companies. Indian businesses must act more quickly on this aspect of their ESG because the Task Force on Nature-related Disclosures.

Social (S)

Human Rights

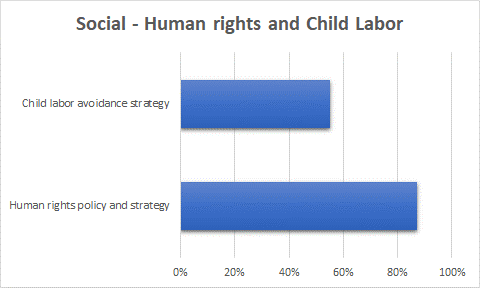

Nearly all the 1,000 top Indian companies we researched, close to 87%, disclosed that they had a human rights policy and strategy, and over half, 55%, disclosed details regarding their child labor avoidance strategy or policy. While this is not sufficient, it is encouraging to see that the majority of leading Indian companies have these key policies and strategies in place.

DEI

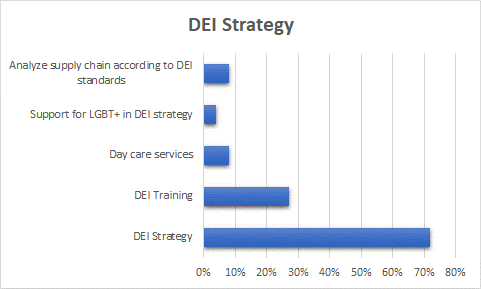

Nearly all the top 1,000 Indian companies, 72%, have a DEI strategy and close to 90% have implemented a diversity grievance reporting mechanism. However, many of these DEI strategies seem to lack important details. Only 27% of these companies offer DEI training, only 4% have specific support for lesbian, gay, bisexual, transexual, and other (LGBT+) identities in their DEI strategy and only 8% offer daycare services, a key requirement for ensuring gender equality at an organization.

However, only 8% of the top 1,000 Indian businesses analyze the DEI standards of their supply chains. As businesses are increasingly required to report on detailed aspects of their supply chain, it is important for Indian businesses to investigate their supply chain from a DEI perspective.

Data Security And Privacy

Most companies, 65% and 76% respectively, have a data privacy strategy and product or service quality strategy. However, only 17% provide training on data privacy and security issues. In addition, only 20% have a consumer safety strategy. As the ICT services hub of the world, it is important for Indian businesses to lead on cybersecurity. Therefore, we would hope to see improvements in this area. You can read our previous articles on data privacy and security metrics here.

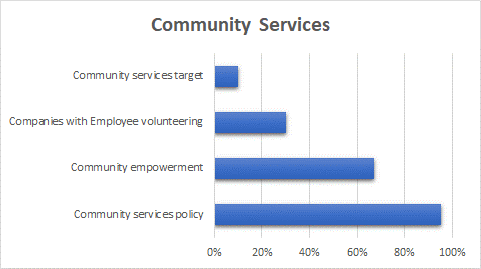

Community Services And Volunteering

Of the top 1,000 Indian companies, the majority, over 95%, have a community services policy, and more than half, 67%, encourage community empowerment. However, only about 30% report that their employees volunteer in the community and only 10% have assigned a community services target.

To increase engagement companies should set community service targets for their employees and find ways to incentivize employees to participate.

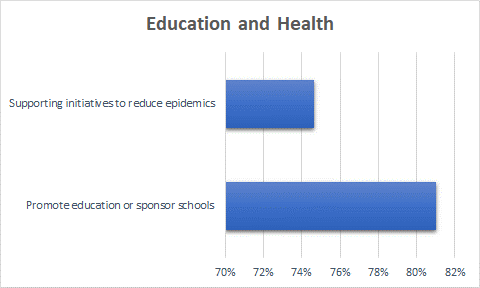

Education & Health

The overwhelming majority of the top 1,000 Indian companies, over 80%, sponsor or build schools and promote education in the communities in which they are based. This is an excellent contribution to the future of the community and the country as well as an investment in the company’s future workforce.

As leaders in vaccine production, Indian businesses are also leading the way in preventing the harm caused by epidemics. In response to the increasing likelihood of epidemics, including the COVID-19 pandemic, a rising number of companies over the past couple of years have been running or supporting initiatives that are designed to reduce the impact of epidemics.

Governance (G)

Gender Equality In Leadership

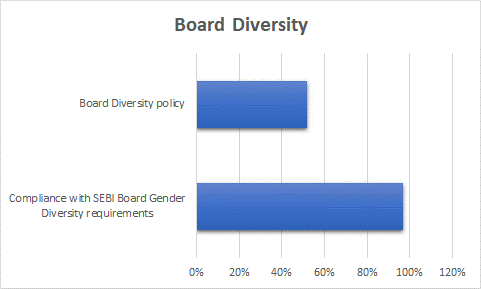

Most of the companies, almost 97%, comply with SEBI’s Board Gender Diversity requirements and disclose this information. However, only 52% of companies have a board diversity policy. Companies should establish a board diversity policy, set targets, and create a strategy to achieve greater board diversity.

Our Recommendations

In summary, among organizations based in emerging markets, India’s top 1,000 businesses are faring well, especially in terms of CSR, governance, and social reporting. However more can and should be done across the board to drive the ESG performance of Indian businesses. In addition to increasing reporting transparency, regulators and the central bank can consider financial incentives for good ESG performance. Businesses must not rely solely on BRSR as the ESG guidepost but should identify relevant risks and set their own aggressive targets on specific ESG performance. Stakeholders will not be satisfied with transparency; they will be looking for impact. Indian businesses that lead in ESG performance today will be the global market leaders of tomorrow.